The introduction of digital payment systems has transformed the way people conduct financial transactions across the world. In Kenya, the most significant development in this area has been the launch of M-Pesa, a mobile money transfer service that revolutionized the country’s financial landscape. Introduced in 2007, M-Pesa has become one of the most successful mobile payment platforms globally, providing millions of people with access to financial services through their mobile phones.

M-Pesa was developed by Vodafone Group and launched by Safaricom, Kenya’s leading telecommunications company. The concept originated from a Vodafone pilot project that aimed to support microfinance loan repayments using mobile phones. However, during the pilot phase, it became evident that users preferred using the platform to send money directly to family and friends rather than solely for loan payments. This shift in usage led to the full development of M-Pesa as a person-to-person money transfer service.

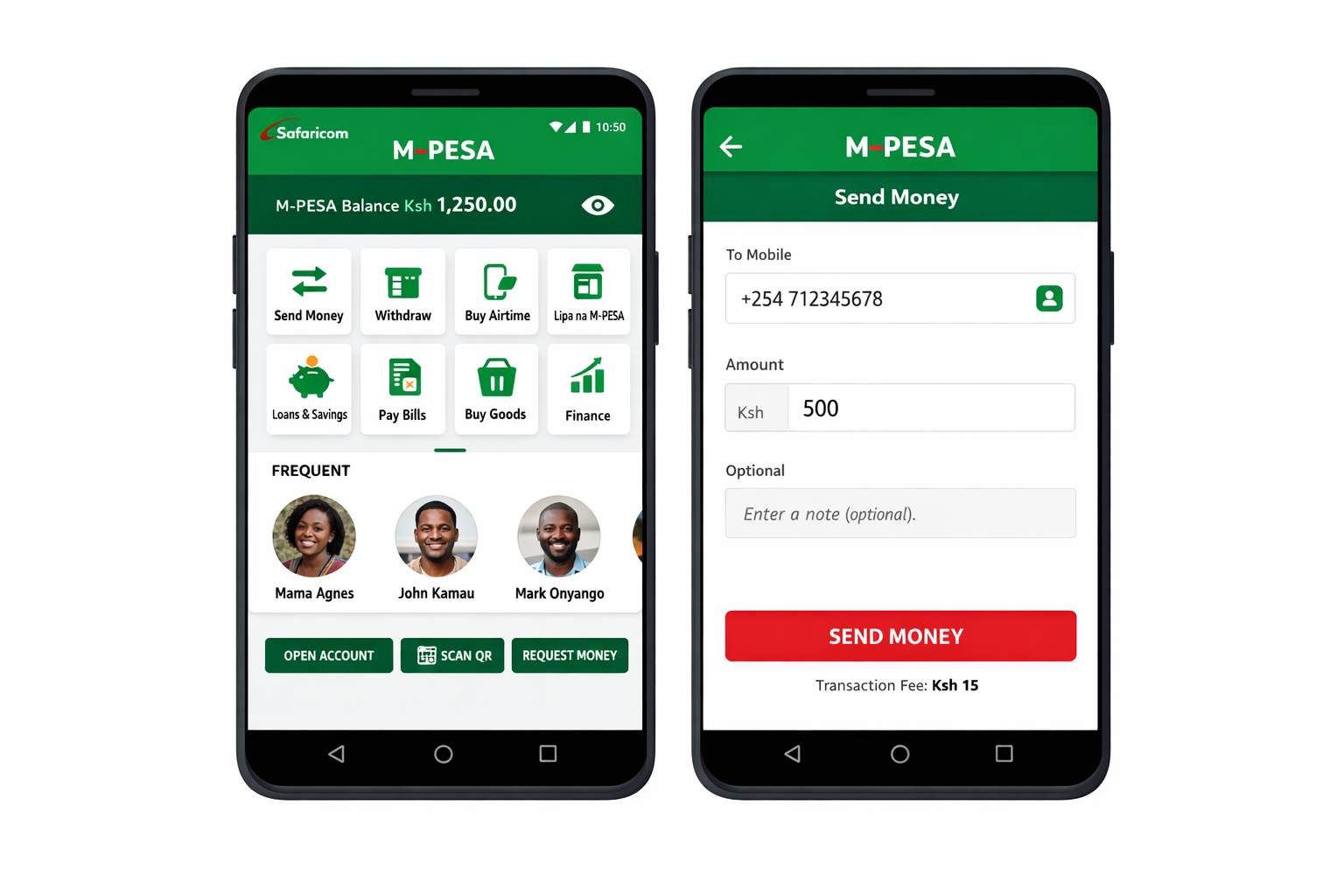

The name M-Pesa is derived from “Mobile” and “Pesa,” the Swahili word for money. At the time of its introduction, a large percentage of Kenyans lacked access to formal banking services, particularly those living in rural areas. Traditional banks were concentrated in urban centers and required strict documentation, making it difficult for many citizens to open accounts. M-Pesa addressed this challenge by allowing users to deposit, withdraw, send, and receive money using simple mobile phones without the need for a bank account.

Safaricom played a crucial role in the success of M-Pesa by leveraging its wide mobile network coverage and strong customer trust. The service was supported by a vast network of agents, including retail shops and kiosks, where users could exchange cash for electronic money. This agent-based model made M-Pesa accessible even in remote areas, contributing to its rapid adoption across the country.

The impact of M-Pesa on Kenya’s economy and society has been profound. It has promoted financial inclusion by bringing millions of unbanked individuals into the formal financial system. Small-scale traders, farmers, and informal sector workers can now receive payments, save money, and access credit through mobile platforms. Over time, M-Pesa expanded its services to include bill payments, airtime purchases, savings, loans, and international money transfers, further strengthening its role in everyday life.

Additionally, M-Pesa has enhanced efficiency and security in financial transactions. It reduced the risks associated with carrying large amounts of cash and minimized transaction costs compared to traditional money transfer methods. Government institutions, businesses, and utility companies have also adopted M-Pesa for payments, increasing transparency and accountability.

Beyond Kenya, M-Pesa’s success inspired similar mobile money services in other countries across Africa and beyond. It has positioned Kenya as a global leader in mobile financial innovation and demonstrated how technology can be used to solve real social and economic challenges.

In conclusion, the introduction of digital M-Pesa payments by Safaricom, with technology developed by Vodafone, marked a turning point in Kenya’s financial history. What began as a simple mobile money transfer service has evolved into a comprehensive digital financial ecosystem. M-Pesa’s success highlights the power of innovation in promoting economic growth, financial inclusion, and social development in the digital age.